By Molly C. Herndon, MS

Teaching children how to responsibly manage money is one of the most valuable lessons a parent can give to a child. But what if the parent has trouble managing their own finances? How can a parent, who may not have received any financial guidance from their own parents or formal financial instruction during their school years, effectively teach a child how to manage money?

Everyday Experiences

Children learn the most by watching their parents do the things they do everyday. Grocery shopping, pumping gas, planning for the holidays, are all excellent chances to start the conversation about finances. Point out items that are on sale and explain how much money is saved when one item is purchased over another. Show children the value of comparison shopping, or buying items second-hand. These lessons are valuable even to the youngest children.

If children are old enough to have their own money, either from gifts or from work, they can begin to understand how budgeting works. Talk about how much an item they desire costs, before you leave for the store. If your son or daughter received $50 for a birthday gift and wants to buy a specific item, do some research together online to figure out the value and where and when would be the best place to make the purchase. This is a valuable chance for a child to learn how far that money really goes.

Allowances

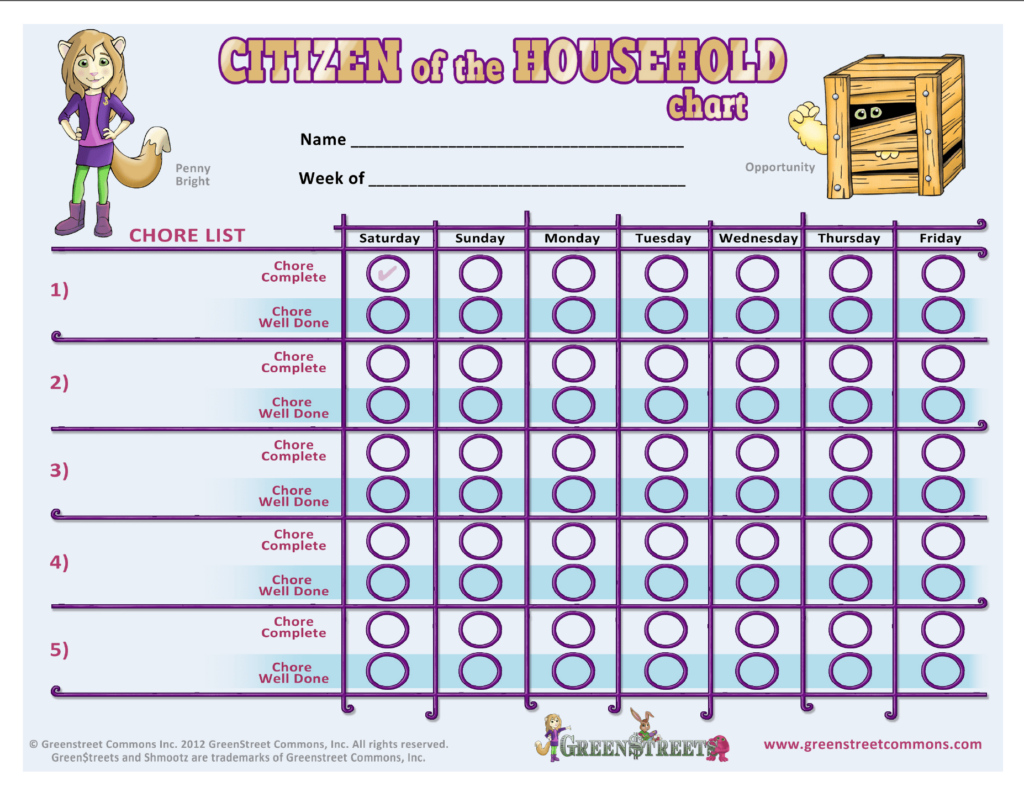

There are several schools of thought on the value of establishing an allowance system. Our November webinar presenter Neale Godfrey has developed a system for young children to earn money and learn money management. Her Citizen of the Household chart is a good tool for developing some tasks your child can earn money completing.

Citizen of the Household Chart. By Neale Godfrey.

Parents and children can follow Ms. Godfrey’s instructions to use this chart and implement systems that work best for their families.

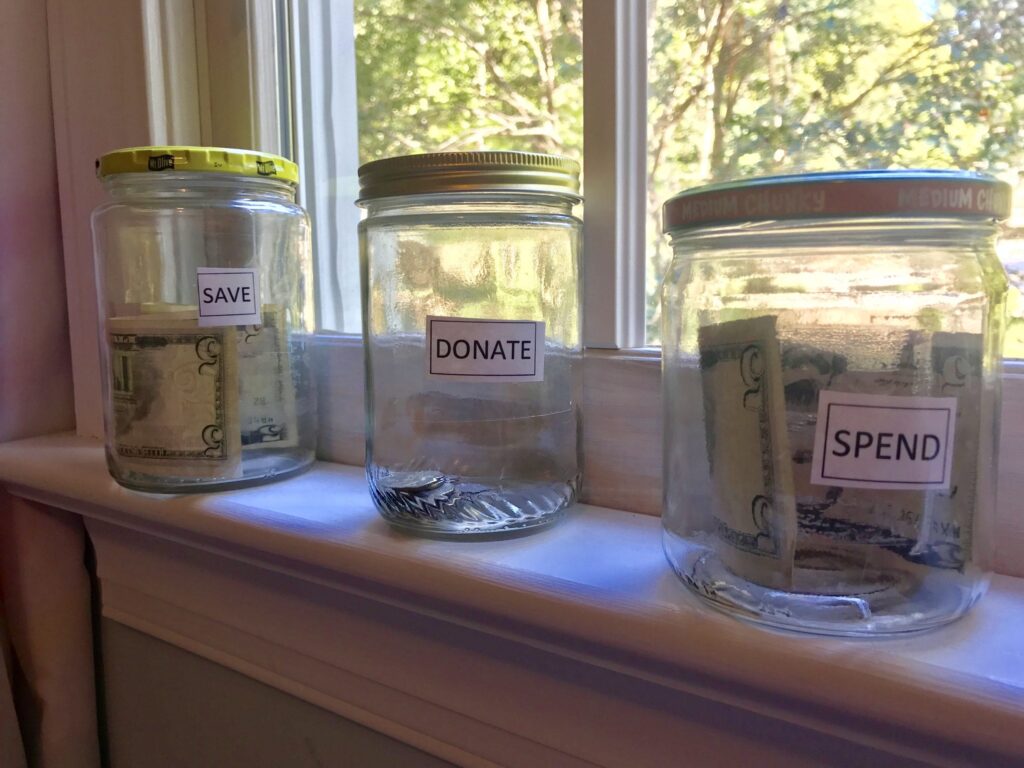

Ms. Godfrey’s allowance system uses 4 clear jars: Charity, Quick Cash, Medium-Term Savings, and Long-Term Savings. Parents can instruct children that 10% of their weekly earnings goes to charity, and help the child select a charity or cause that is important to them. Next, Quick Cash is for items the child wants to buy right away, and Medium-Term Savings is for larger, more expensive items the child can learn to save for. For children, most Long-Term Savings is for college expenses, Ms. Godfrey says.

Photo by Molly Herndon

Websites, Games and Books

During a 2012 webinar, we asked participants to share the titles of books they’ve use or suggested to parents to use with their child to teach them about finances:

All the Money in the World by Charles Robinson

Mall Mania by Stuart J. Murphy

Alexander, Who Used to Be Rich Last Sunday by Judith Viorst

A Bargain For Frances by Russel Hoban

A Chair For My Mother by Vera Williams

Just Shopping With Mom by Mercer Mayer

My First Job by Julia Allen

Ox-Cart Man by Donald Hall

Sheep in a Shop by Nancy Shaw

Something Good by Robert Munsch

The Berenstain Bears & Mama’s New Job by Stan & Jan Berenstain

The Berenstain Bears’ Trouble With Money by Stan & Jan Berenstain

The Purse by Kathy Caple

Tight Times by Barbara Shook Hazen

Websites webinar participants shared were:

financeintheclassroom.org

AER Scholarships

Themint.org

Nefe.org

Practicalmoneyskills.com

Jumpstart.org

Choosetosave.org

Moneyhabitudes.com

Kids and Money video podcasts

Small Steps to Wealth & Health

And many games, both online and board games, teach finances. Think about Monopoly? There are some valuable lessons learned when you land on Boardwalk! Other games are listed here.

What books, games or online resources have you used or suggested to parents? Share in the comments.

Join us November 27 as Neale Godfrey dives into this topic in more detail. This interactive webinar will include quizzes to asses money management style and tools and resources to help parents teach their children a critical skill. This webinar is free and is approved for 1.5 CEUs for AFCs, CPFCs, social workers, family therapists and counselors. RSVP and learn more here.

Photo credit: Storytime

References

How to Teach Your Child Money Management

![Blog Post Image: Pexels [Silhouette Photo of Jumping Children, photo by Margaret Weir, Sept. 22, 2017, CC0]](https://oneop.org/wp-content/uploads/2024/04/pexels-margaret-weir-620530-600x403.jpg)