By Barbara O’Neill, Ph.D., CFP®, [email protected]

With an average U.S. life expectancy of 78.7 and many people living longer, the cost of long-term care is an increasing financial risk.

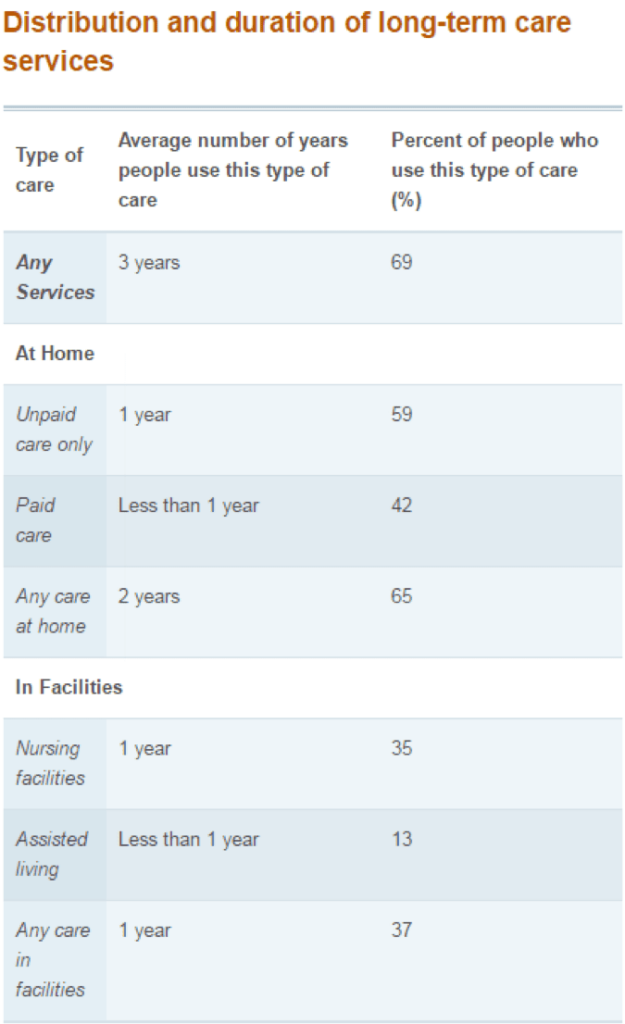

The term “long-term care” refers to a wide range of services ranging from limited assistance at home with daily activities to admission to a nursing home for intensive medical care and support.

Source: U.S. Department of Health, http://longtermcare.gov/the-basics/how-much-care-will-you-need

Everyone needs a long-term care plan.

The risk of long-term care can be dealt with in three ways:

- Retain it: People with a sufficient net worth can self-insure

- Avoid it : Practicing healthy lifestyle habits is great but there are no guarantees

- Transfer it: Pay an insurance company to handle the risk

In the 1990s, more than 100 insurers sold long-term care (LTC) policies. Today, due to uncertainties about the cost of future claims, less than a dozen insurance companies sell LTC policies. The average annual premium for a 55-year old couple was $3,050 in 2019, with costs rising as people get older.

Do you need long-term care (LTC) insurance?

Some guidelines to consider:

- A good rule of thumb, according to Kiplinger’s Retirement Report, is that no more than 10% of your annual income should be spent on premiums (e.g., $3,500 premium with a $35,000 income).

- The best time to purchase a policy is generally before age 60. If you wait too long, premiums increase and/or you could become uninsurable through some type of pre-existing condition. If you buy in your 40s or 50s, you could be paying premiums for a long time before coverage is actually needed.

- Couples often need long-term care insurance more than singles. If one spouse ends up in a nursing home, it can greatly reduce the number of assets left for the well spouse.

Photo by Geralt/Pixabay.com, CC0

Additional tips for purchasing long-term care insurance:

- Understand how you qualify for benefits. Coverage generally begins when a person is unable to perform a certain number of “activities of daily living” or ADLs (e.g., bathing, dressing).

- Purchase inflation protection to increase the number of benefits over time. A “compound” inflation rider results in a larger benefit increase than a “simple” inflation rider, but it also costs more. The difference is that a simple inflation rider is calculated on the original benefit amount, while the compound inflation rider is based on the (inflation-adjusted) amount paid during the previous year.

- Choose an elimination period based on the number of days of care you can afford to pay for out-of-pocket. An elimination period is the amount of time between when care begins and when benefits are paid. Elimination periods can range from zero to 90 days to a 365-day waiting period for people who can afford to pay for a full year of care in exchange for a lower premium.

- Two additional key decisions are the length of time you will receive benefits (the range is one year to an insured’s remaining lifetime) and the benefit amount, often a specific number of dollars per day. The longer the benefit period, and the higher the policy benefit, the higher the cost.

- Contact your local SHIP (State Health Insurance Assistance Program) office for information and counseling about available LTC policies in your state. In some states, this program has a different name such as SHINE in Florida and South Dakota. SHIP offices also have information about available Medicare supplement insurance.

Photo by UFIfAS, Marisol Amador

![Blog Post Image: Pexels [Silhouette Photo of Jumping Children, photo by Margaret Weir, Sept. 22, 2017, CC0]](https://oneop.org/wp-content/uploads/2024/04/pexels-margaret-weir-620530-600x403.jpg)