By Barbara O’Neill, Ph.D., CFP®, Rutgers Cooperative Extension, [email protected]

A critical personal finance skill is knowing how to read a mutual fund prospectus. It is not uncommon for workers in employer retirement savings plans (e.g., 401(k) and 403(b) plans) to be given a stack of prospectuses to decipher to choose investments to put into their accounts. This post will explain nine key sections of a mutual fund prospectus:

A critical personal finance skill is knowing how to read a mutual fund prospectus. It is not uncommon for workers in employer retirement savings plans (e.g., 401(k) and 403(b) plans) to be given a stack of prospectuses to decipher to choose investments to put into their accounts. This post will explain nine key sections of a mutual fund prospectus:

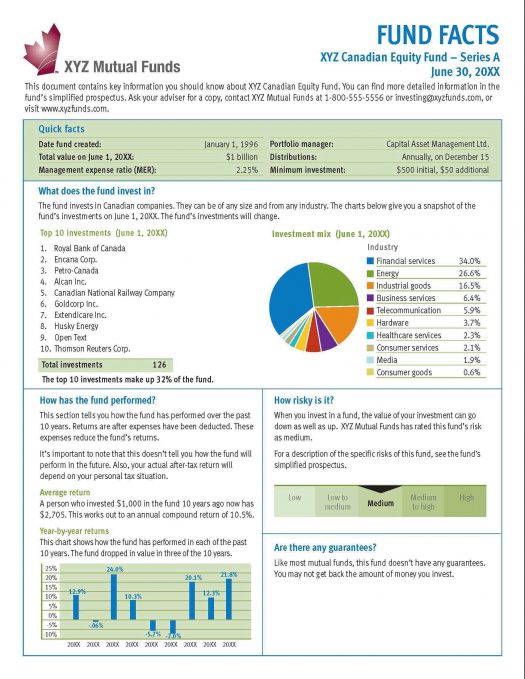

- Name of Fund(s)- A prospectus may include one mutual fund or several related funds from the same investment company (e.g., fund “families” such as Fidelity, Vanguard, and T.Rowe Price). Prospectuses are typically updated annually.

- Required Legal Statement- The fund prospectus must clearly state in bold print that there is no government approval of the mutual fund and that for anyone to state that there is approval is a crime.

- Fund Objective- The fund prospectus must state the fund’s investment objective, which varies with the type of mutual fund. Three primary mutual fund objectives are preservation of principal (e.g., money market mutual funds), generating income (e.g., bond funds), and long-term growth (e.g., stock funds).

- Fees and Expenses– Prospectuses must disclose fees charged to an individual investor’s account (e.g., account maintenance fee) and annual fund expenses expressed as a percentage of fund assets. The latter is called an expense ratio and includes the fund’s management fee, marketing expenses, and other charges.

- Investment Policies- A fund’s prospectus must describe what the fund will and will not do. For example, a bond fund prospectus will state the investment quality (bond rating) of the bonds in its portfolio and a stock fund prospectus will state if it uses risky practices such as derivative securities and selling stocks on margin.

- Investment Advisor Information- A prospectus will state the name of a fund advisor (e.g., Vanguard Group or the name of an individual fund manager), their years of experience, and amount of assets under management.

- Fund Distributions and Taxes- Prospectuses will tell investors the frequency of fund distributions (dividends and capital gains) and warn them that the sale or exchange of shares is a “taxable event” (i.e., capital gain or loss). They will also describe the procedure for reinvesting distributions.

- How to Purchase Shares- Methods of purchase (e.g., online, by check, or via an exchange of shares from another mutual fund) are described in a prospectus. Also included are the minimum purchase amounts for initial account deposits and subsequent share purchases.

- How to Redeem Shares- Methods by which shares can be redeemed (e.g., check-writing, telephone, online, and written requests) are described as well as the price at which shares are redeemed.

Mutual fund prospectuses are a mutual fund screening tool to help investors make a “side by side” comparison of similar types of mutual funds (e.g., three different stock index funds). They are also a reference tool. File the most recent prospectus for funds that you own with annual statements of mutual fund deposits and withdrawals. Refer to prospectuses as needed (e.g., at tax time or when making deposits and withdrawals).

For additional information about mutual fund prospectuses, watch OneOp webinar Fundamentals of Mutual Funds.