By Selena Garrison

We acknowledge that many families facing financial hardship due to COVID-19 are unable to save money right now. We hope the information provided in this blog series will serve as a helpful resource, during National Financial Capability Month, for Personal Finance Managers to enhance the money management skills of families who have discretionary income.

At this point in the series, we have worked through helping clients to (1) track their spending, (2) identify how much money they have coming in, (3) distinguish between fixed and flexible expenses, and (4) determine whether they are living on what they make. While many financial professionals have their clients set financial goals at the beginning of the financial planning process, I prefer to do it once they have a solid idea of where they currently stand financially. You can choose to do it either way with the people that you serve.

When it comes to setting financial goals, the SMART model of goal setting is a great starting point. SMART goals are:

Specific – Your client should specify exactly what will be done with their money.

Measurable – Your client knows the exact dollar amount it is going to take to reach the goal.

Attainable – Your client has a step-by-step plan to reach the goal.

Realistic – Your client’s goal is something that can be attained based on his or her financial situation.

Time Bound – Your client has a specified date.

Example of converting a goal to a SMART goal

Goal: Your client wants to purchase a used vehicle.

SMART goal: Your client wants to purchase a certified pre-owned SUV (S) for $6,500 (M) in 6 months (T). He or she currently has $3,000 saved and will need to save an additional $583.34 per month for the next 6 months (A). He or she currently has a budget surplus of $600 (R).

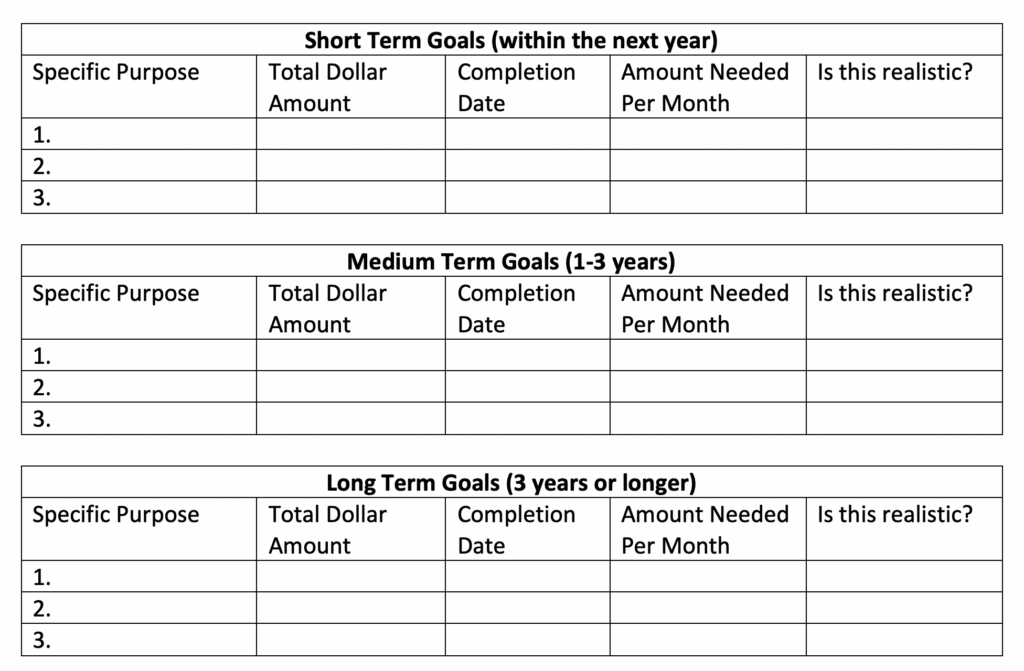

Clients may find it useful to set their goals with a time orientation of short-term (within the next year), medium-term (in the next 1-3 years), and long-term (3 years or longer).

To bring that all together, your client can fill out tables such as these with their goals.

As your clients are working on determining their goals, it is important that they continue to consider how each goal fits into their spending plan.

Image by gabrielle_cc from Pixabay