By Selena Garrison, University of Florida

We acknowledge that many families facing financial hardship due to COVID-19 are unable to save money right now. We hope the information provided in this blog series will serve as a helpful resource, during National Financial Capability Month, for Personal Finance Managers to enhance the money management skills of families who have discretionary income.

This series is aimed at getting started with the basics of budgeting. Follow along from the first post in the series to get started.

Once the expenses and income have been tracked for a month, the next step is to divide their expenses into fixed expenses and flexible expenses. This helps to give people a handle on the expenses that stay around the same amount each month (fixed expenses) and those that vary from month-to-month (flexible expenses).

Fixed expenses generally include some kind of contract or agreement on an amount that must be paid. Many are paid monthly, but some occasional fixed expenses may be paid quarterly, every six months, or once a year. These expenses include things like:

- Rent/mortgage

- Childcare/school tuition

- Utility bills (water, electric, gas, etc.)

- Cell phone bills

- Installment loans (car payment, student loans, etc.)

- Insurance premiums

- Vehicle registration

- Memberships (gym, professional associations, etc)

Flexible expenses generally vary in amount month-to-month and don’t usually include an agreement or contract. Usually, people have more control over variable expenses and can look to these areas to cut back on spending if money gets tight or if they want to focus on different financial goals like saving and paying off debt. They include things like:

- Food (groceries, eating out, vending machines)

- Clothing and related expenses (new clothes purchases, dry cleaning)

- Transportation (gas, car repairs)

- Recreation (entertainment, vacations)

- Personal care (massages, manicures, haircuts)

- Gifts and donations

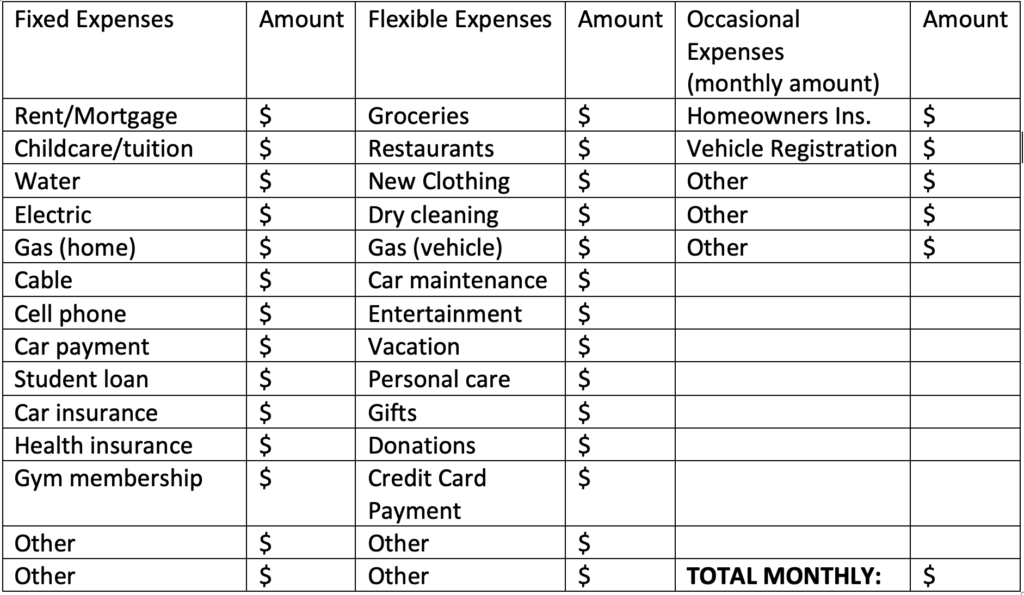

Once someone has tracked all of their expenses for an entire month, they can use a worksheet or spreadsheet (like the Financial Capability Spending Plan Template) like the one below to divide their fixed and flexible monthly expenses, as well as those that come up more occasionally.

Download the Financial Capability Spending Plan Template here