By Selena Garrison

We acknowledge that many families facing financial hardship due to COVID-19 are unable to save money right now. We hope the information provided in this blog series will serve as a helpful resource, during National Financial Capability Month, for Personal Finance Managers to enhance the money management skills of families who have discretionary income.

So far in this series, we have focused on teaching clients how to (1) track their spending, (2) identify how much money they have coming in, and (3) distinguish between fixed and flexible expenses. Today, we will focus on helping clients to determine whether they are living within their means. In other words, are they living on what they make or spending more than they have coming in?

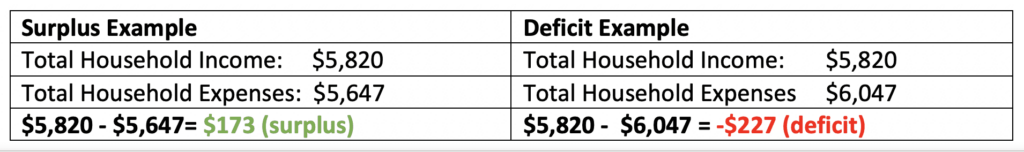

The process is relatively simple. First, the client will add up all of their expenses for the past month. Second, he or she will add up all of their household income for the past month. Then they will subtract their expenses from their income. If they have spent less than they have earned, the dollar amount will be positive, indicating a surplus. If they have spent more than they have earned, the dollar amount will be negative indicating a deficit.

If the client has a surplus, that means that they are living within their means, with some money left over to put toward financial goals such as emergency savings, retirement, vacation, etc.

If the client has a deficit, that means that they are spending more than they are making, which oftentimes means that they are spending down savings or relying on credit to make ends meet. This is not a sustainable pattern and can eventually lead to overwhelming debt and other financial issues.

In order to relieve a deficit, and avoid spending more than he or she earns, (or in order to increase a surplus and have more money left over for other goals) there are three options: spend less, earn more, or do both.

For most people, spending less is the most feasible immediate option. To do so, they can go back over their tracked fixed and flexible expenses and see where they can make adjustments to their spending. If there is no way to cut back spending, they can consider taking on an additional job. If it is feasible, the client can also choose to cut back on spending and increase their income. For many people, this allows them to completely alleviate any deficit and build a strong surplus to put toward other financial goals.

Image by edar from Pixabay