By Barbara O’Neill, Ph.D., CFP®, [email protected]

Personal Financial Managers (PFMs) often find themselves discussing the “4 B’s of Basic Personal Finance” with service members. The 4 B’s are Budgeting, Banking, Borrowing, and Buying.

Below are action steps for each of the 4 B’s for PFMs to share with service members:

Budgeting

- Use the alternative name “spending plan” to avoid negative images associated with the word “budget.

- Identify the daily, weekly, monthly, and annual cost discretionary expenses that add up over time.

- Brainstorm specific ways to increase income and reduce expenses to achieve flat or positive cash flow.

- Track spending for a month or two to confirm accurate numbers to use in a spending plan.

- Use the CFPB Bill Calendar tool to list due dates for all household expenses together on one sheet of paper.

- Determine preferred method(s) to pay bills (cash, checks, debit card, credit card, and/or peer-to-peer apps).

- Determine money values using several online self-assessment tools. Search “values clarification activity.”

- Write smart goals with a specific dollar amount and a time deadline using the goal-setting template below.

Graphic by Dr. Barbara O’Neill

Banking

- Compare at least three financial institutions (e.g., brick and mortar banks, online banks, and credit unions).

- Consider these features: fees, interest rates, minimum deposits, online access, free ATMs, and military perks.

- Avoid high-cost “foreign ATMs,” especially those located at stadiums, amusement parks, fairs, and casinos.

- Seek lower-cost alternatives to high-cost alternative financial services (e.g., payday loans and check-cashers).

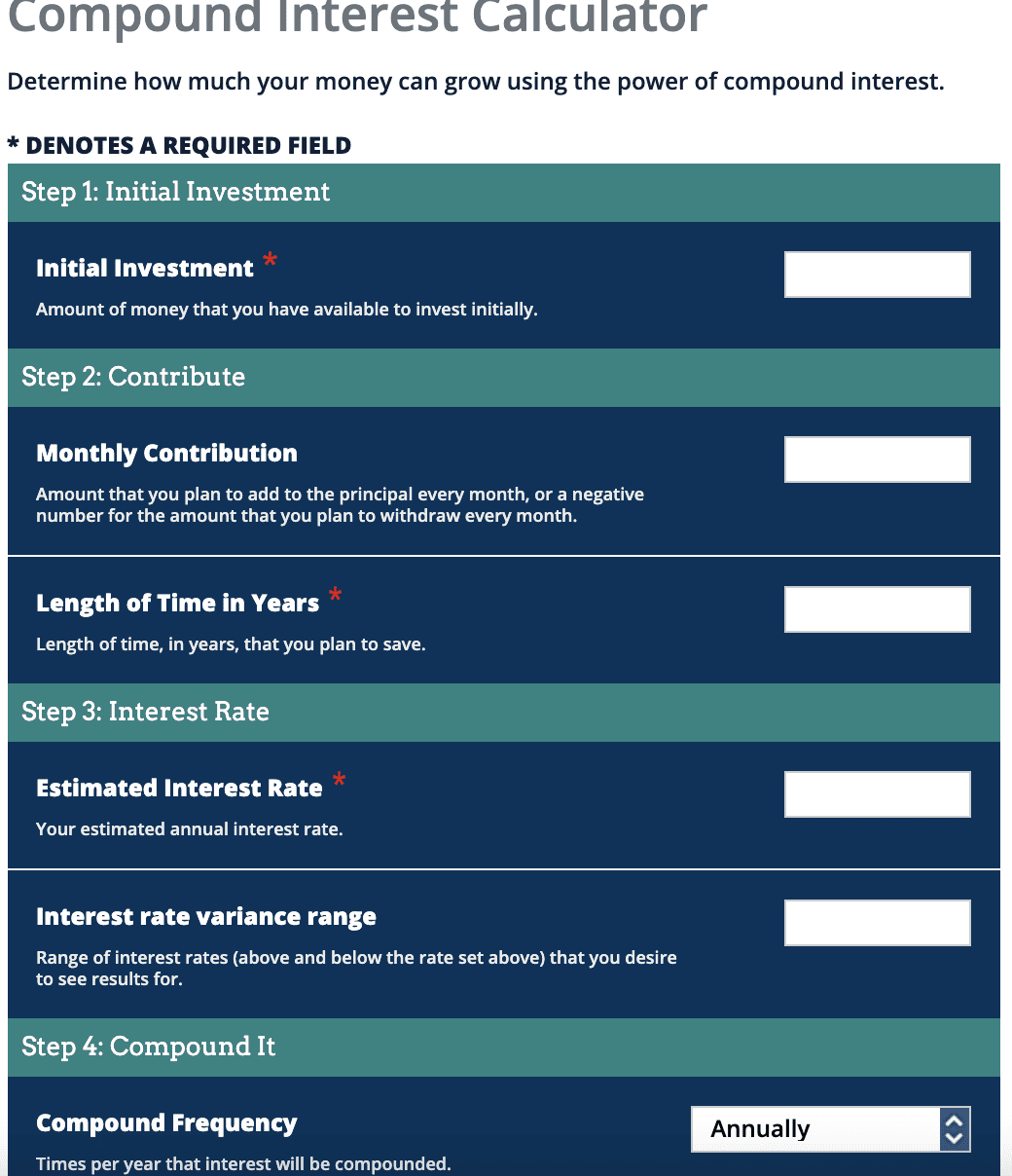

- Compare the annual percentage yield (APY) on bank accounts (more frequent compounding = higher APY).

- Reconcile personal checking account balance with your bank statement’s ending balance at least monthly.

- Learn to appreciate the awesome power of compound interest using the investor.gov online calculator.

- Understand how a sum of money doubles (by time period or interest rate) by learning the Rule of 72.

Borrowing

- Learn 5 creditworthiness Cs: Character, Capacity (to repay), Capital, Collateral, and (economic) C

- Seek credit cards with a low APR and penalty APR (interest), low fees, no annual fee, and good rewards.

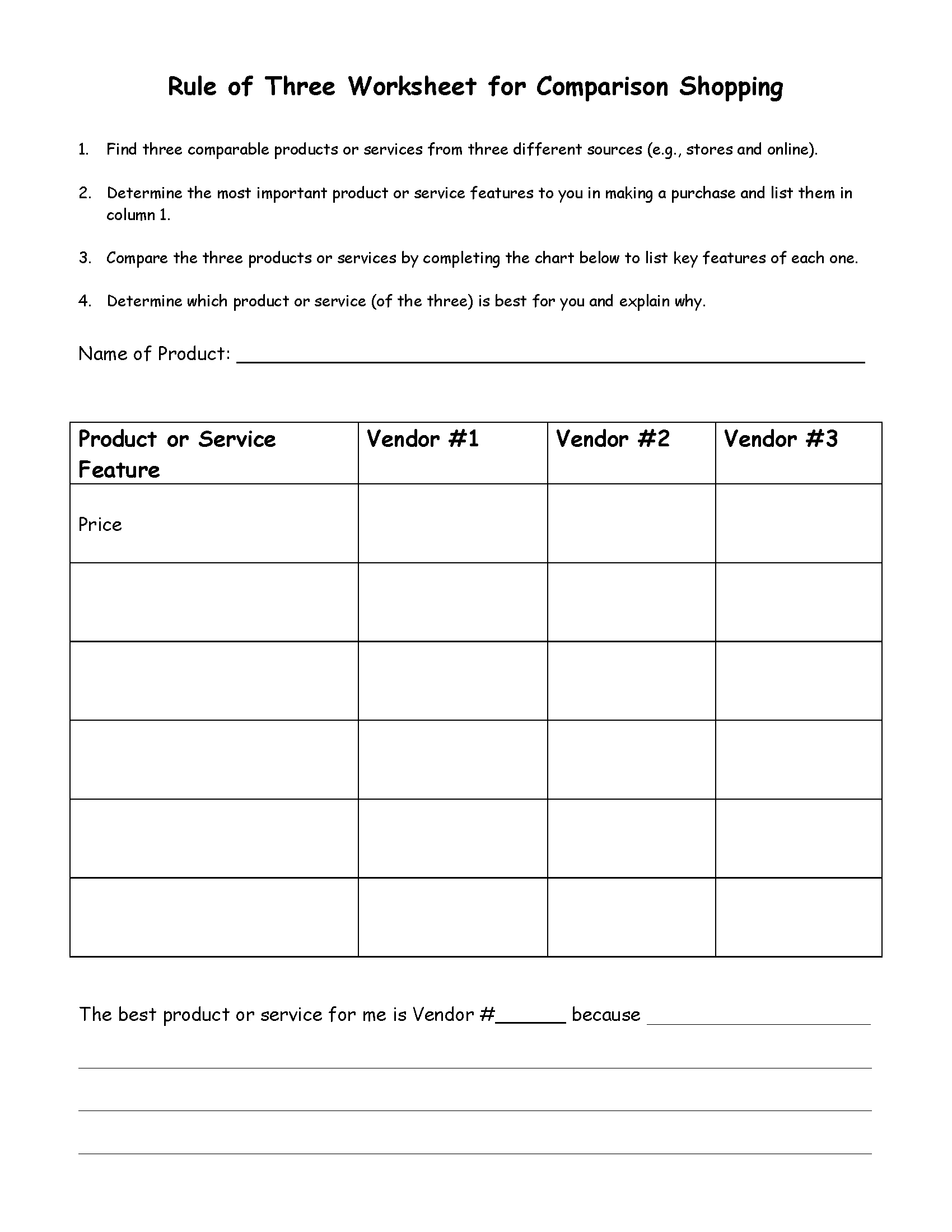

- Compare at least three credit cards by reading the Schumer (disclosure) box and contrasting key features.

- Pay at least double the minimum payment if a credit card bill cannot be paid in full to avoid “perma-debt.”

- Check credit reports from each “big three” credit bureau (Experian, Equifax, TransUnion) annually.

- Check credit scores regularly; many banks and credit card issuers provide free scores to their customers.

- Avoid a student loan balance greater than the first-year starting income in a post-degree job.

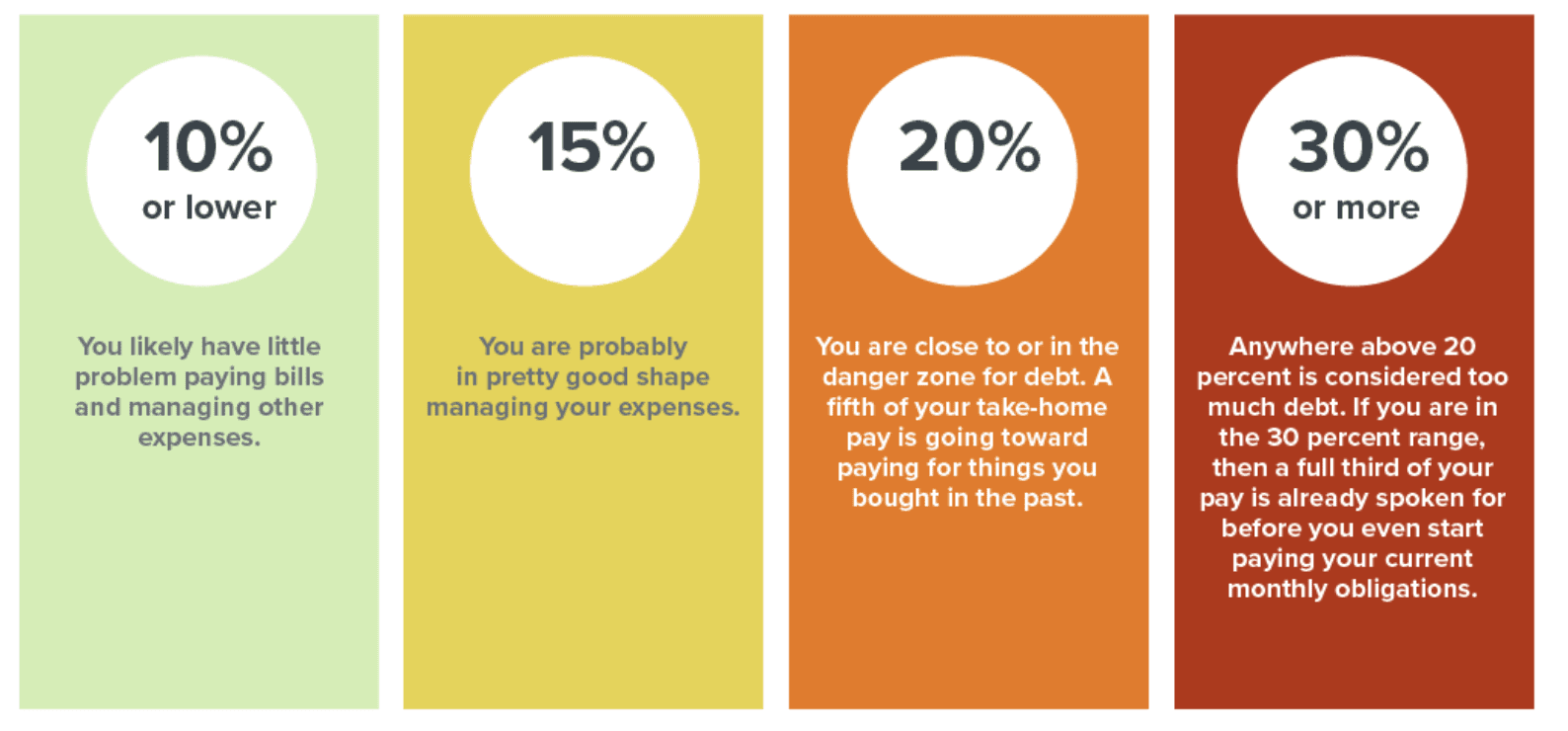

- Keep the total of monthly consumer debt payments at less than 15% to 20% of monthly net (take-home) pay.

Source: smartaboutmoney.org

Buying

- Think about expensive purchases made in the past and lessons learned during the shopping process.

- Check sources of independent consumer product shopping research such as Consumer Reports.

- List “must-have” and “nice to have” features in upcoming “big ticket” purchases (e.g., a car).

- Compare and contrast the pros and cons of new car buying, used car buying, and auto leasing.

- Use an online calculator to determine car loan payments for different loan amounts.

- Avoid being “upside-down” on a car loan with a large down payment and/or a short loan term.

- Use the “Rule of Three” to compare three features and costs of similar “big ticket” purchases.

Photo by Liza Summer on Pexels