By Kristen Jowers, MS MFT

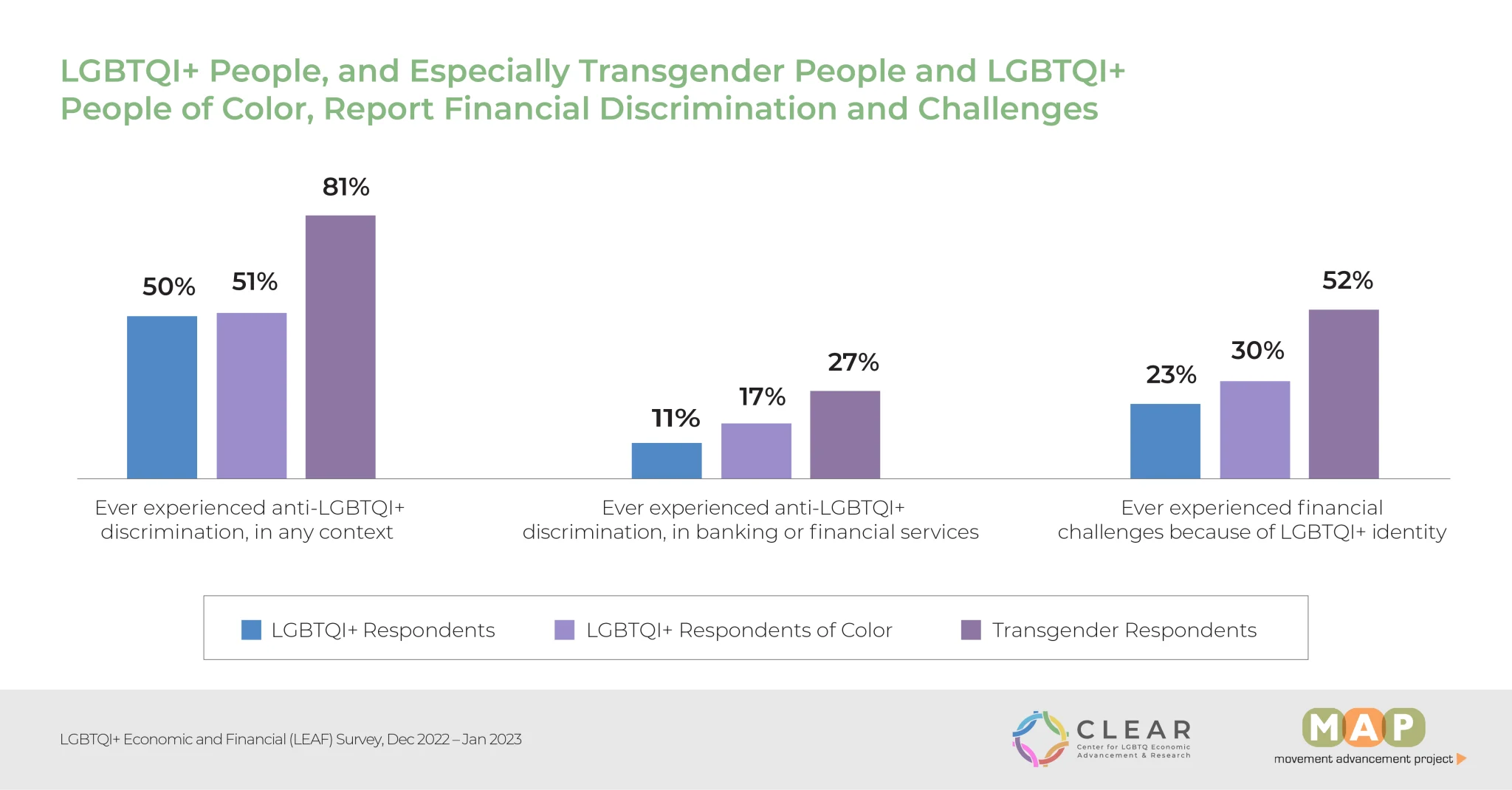

Pride Month is a time to celebrate the LGBTQ+ community, honor its history, and promote inclusivity and acceptance. According to a survey conducted by the Center for LGBTQ+ Economic Advancement & Research, 27% of transgender respondents experienced anti-LGBTQ+ discrimination in banking or financial services and 52% reported experiencing financial challenges because of LGBTQ+ identity (Watson et al., 2023). As financial service professionals empowered with the knowledge of LGBTQ+ experiences shared in the survey, we can “take proactive steps to foster financial empowerment and inclusivity” and work together to “create a more equitable and inclusive financial landscape for all” (AFCPE, 2021).

Source: Center for LGBTQ+ Economic Advancement & Research

Here are three opportunities for Personal Financial Managers to consider in their work with LGBTQ+ Service Members, and their families.

- Inclusivity and Sensitivity: Service professionals should demonstrate cultural competence, use inclusive language, and be sensitive to the diverse experiences and identities within the LGBTQ+ community, including the use of appropriate names and pronouns. With that, financial service professionals can create a safe and inclusive space for the varying financial priorities of LGBTQ+ clients. One way to easily integrate inclusivity into your workspace is to add your pronouns to your signature line or virtual name tags.

- Understanding LGBTQ+ Financial Needs: Financial service providers should have knowledge of the financial priorities of their clients. According to the LEAF survey report, LBGTQI+ respondents are prioritizing paying bills on time, debt payoff, improving credit scores, and saving for gender-affirming care (Watson et al., 2023). Additionally, service providers should be aware of the unique financial challenges faced by the LGBTQ+ community ranging from housing discrimination to discrimination in lending, and food insecurity.

- Resources and Support Networks: Financial service providers should be aware of LGBTQ+-affirming resources, organizations, and support networks that can provide additional assistance and guidance to clients. These may include LGBTQ+-focused financial education resources and LGBTQ+-affirming communities for service members.

Recognizing the intersectionality of pride and personal finance is a great starting point. It’s essential for financial service providers to continually educate themselves, stay up-to-date with evolving LGBTQ+ issues, and engage in ongoing professional development to best support their LGBTQ+ clients during Pride Month and every month. For affirmative care best practices and LGBTQ+ considerations to integrate into your professional practice, we encourage you to check out OneOp’s on-demand webinar, Providing Affirmative Care to the LGBTQ+ Military Community.

Resources:

Watson, S., Casey, L., Medina, C., Mahowald, L. (2023). The LGBTQI+ Economic and Financial (LEAF) Survey: Understanding the Financial Lives of LGBTQI+ People in the United States. Retrieved from https://lgbtq-economics.org/wp-content/uploads/2023/03/LEAF-Survey-Report-March-2023.pdf AFCPE

AFCPE (2021) Retrieved from https://www.afcpe.org/news-and-publications/the-standard/2nd-quarter-2021/inclusion-of-lgbtqa-individuals-in-the-financial-counseling-space/

Cover photo by Senior Airman Shannon Braaten on dvidshub.net