Written by: Jenny Rea, Ph.D., and Nichole Huff, Ph.D., CFLE

As service providers address the needs of military families, grasping their unique financial challenges becomes paramount. Various aspects of military life can significantly affect a service member’s or a military family’s capacity to meet financial obligations. Transitions within the military life cycle, such as joining the military, undergoing a permanent change of station (PCS), deployment, or encountering major life events like marriage or adoption, exemplify this impact. These transitions often trigger a cascade effect on individual and family financial readiness, further supporting other facets of military family well-being.

Financial Challenges Confronting Military Families

Military families confront a multitude of financial hurdles. Recent insights from the 2023 Office of Financial Readiness (FINRED) report disclosed that 35% of both Active duty and Reserve Component service members encountered one or more financial challenges, an increase compared to 25% and 24% in 2020, respectively. The top three commonly cited financial challenges included:

- Providing unplanned financial assistance to family members outside their household.

- Experiencing personal relationship strain with partners due to financial matters.

- Resorting to borrowing money from family or friends to cover expenses (FINRED, 2023, p. 12).

As service members and military families navigate different phases of military life, they may confront additional obstacles affecting financial readiness, such as:

- Frequent relocations disrupt career advancement for spouses/partners, hindering their ability to secure stable employment or progress in their careers.

- PCSing often involves substantial expenses like travel, lodging, and costs linked to setting up a new household and straining family finances.

- Fluctuations in job market dynamics, inflation rates, and regional economic variations influence family income (Congressional Research Service, 2022).

Strategies to Bolster Military Families’ Financial Preparedness

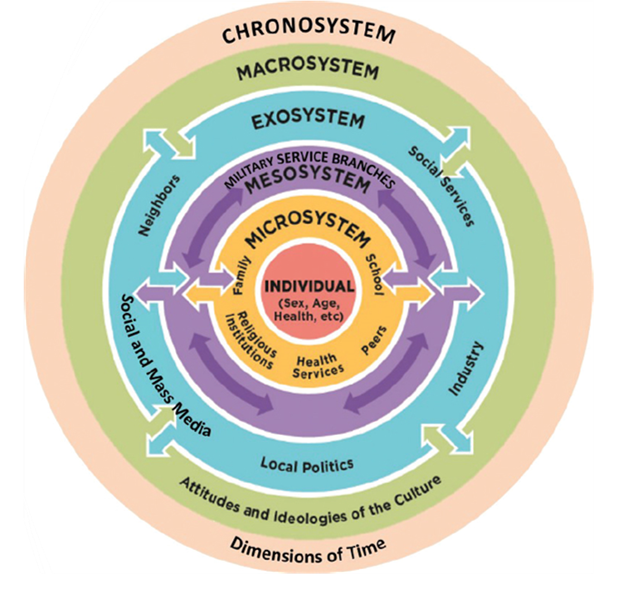

One approach for service providers to aid military families with their financial challenges involves examining the multifaceted factors contributing to their financial readiness. Utilizing a bioecological model allows for understanding the intricate interplay between individuals and their environment. Bronfenbrenner and Morris (2007) model, depicted below, serves as a framework emphasizing the interconnectedness of various factors across multiple levels (individual, interpersonal, community, societal), shaping behavior, health outcomes, and well-being.

Image Adapted from Small et al. (2013).

At each level, service members and military families engage in diverse behaviors, interact with multiple networks, and are influenced by external factors. To better comprehend this model and apply it in supporting financial readiness among this population, here are a few examples:

- At the individual level (microsystem), enhancing financial readiness empowers service members to fulfill their basic needs and pursue personal aspirations. Service providers can offer financial literacy and effective money management skills, enabling individuals to make informed financial decisions, and fostering a sense of control and autonomy.

- At the exosystem level, financial readiness may be influenced by military and federal policies, including military pay and allowances. Service providers can assist military families in accessing social services and educational opportunities.

- At the chronosystem level, interventions such as financial education often prove more impactful during life transitions (e.g., major life events like adopting a child or receiving a promotion), influencing individual and family financial preparedness and enhancing the overall quality of life positively.

Conclusion

A fundamental understanding of financial readiness stands as a critical component of personal and mission readiness, resilience, and retention. It underscores the importance of ensuring that service members and their families have access to financial education and counseling, aiding them in developing knowledge, skills, and strategies to effectively manage their financial responsibilities throughout their career.

Dr. Rea and Dr. Huff co-authored the 2024 Military Family Readiness Academy course, Foundations for Military Family Financial Readiness. This foundational course provides an overview of the impacts of financial readiness on military family well-being. Emphasis will be placed on understanding the financial foundations of economic security, including social and economic drivers required to reach and sustain improved quality of life among military families.

References

Bronfenbrenner, U., and Morris, P. A. (2007). The bioecological model of human development. In W. Damon and R. Lerner (Eds.), Handbook of Child Psychology (6th ed., vol. 1, pp. 793–828). Hoboken, NJ: John Wiley & Sons, Inc. Retrieved from https://onlinelibrary.wiley.com/doi/abs/10.1002/9780470147658.chpsy0114

CFPB. (2015). Financial well-being: The goal of financial education. Available: https://www.consumerfinance.gov/data-research/research-reports/financial-well-being/

Congressional Research Service. (2022, January 12). Military families and financial readiness. Retrieved from https://crsreports.congress.gov/product/pdf/R/R46983

DoD Instruction 1322.34 Financial Readiness of Service Members (p. 4) Available: https://www.esd.whs.mil/Portals/54/Documents/DD/issuances/dodi/132234p.PDF?ver=ja9vCcfvKd9gtFxbkWzCdA%3D%3D

National Academies of Sciences, Engineering, and Medicine. 2019. Strengthening the Military Family Readiness System for a Changing American Society. Washington, DC: The National Academies Press. https://doi.org/10.17226/25380.

Office of the Under Secretary of Defense for Personnel and Readiness. (2023, December). Annual Report on the Financial Literacy and Preparedness of Members of the Armed Forces: Results from the 2022 Status of Forces Survey. Retrieved from https://finred.usalearning.gov/assets/downloads/FINRED-2023-FinancialLiteracy-R.pdf.pdf

Small, N., Raghavan, R., and Pawson, N. (2013). An ecological approach to seeking and utilizing the views of young people with intellectual disabilities in transition planning. Journal of Intellectual Disabilities, 17(4), 283–300. National Academies of Sciences, Engineering, and Medicine. 2019. Strengthening the Military Family Readiness System for a Changing American Society. Washington, DC: The National Academies Press. https://doi.org/10.17226/25380.

Photo by Pormezz / Adobe Stock